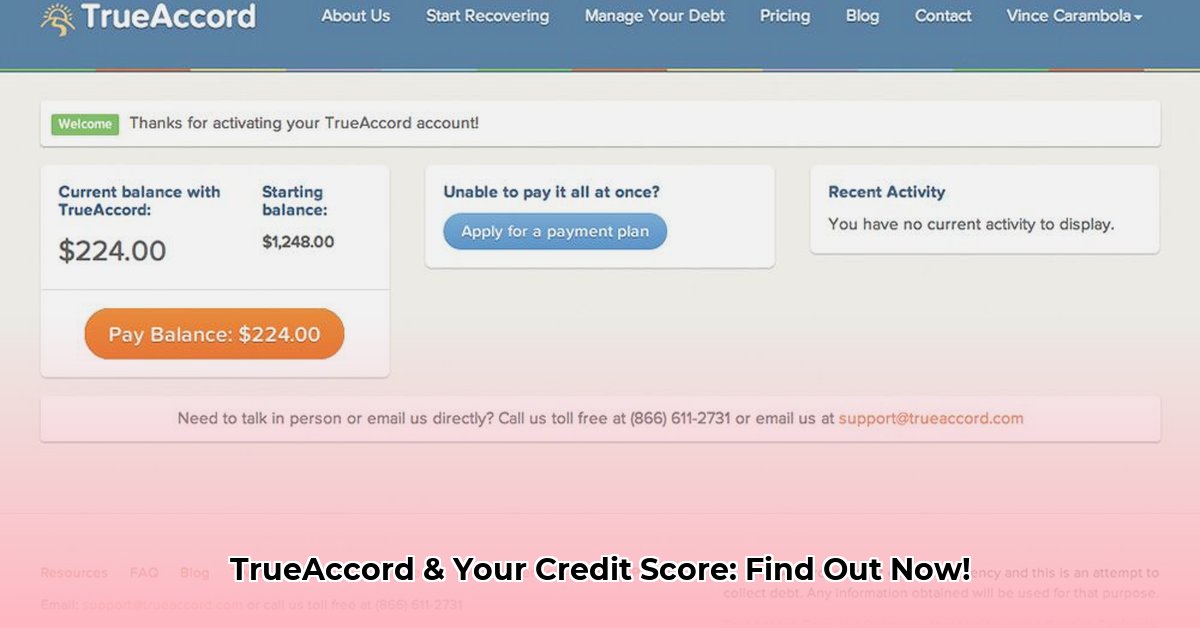

Does TrueAccord Report to Credit?

Many consumers facing debt find themselves interacting with TrueAccord, a debt resolution company. A common question arises: Does TrueAccord report to the major credit bureaus (Equifax, Experian, and TransUnion)? The answer is nuanced. TrueAccord itself doesn't directly report to these bureaus. However, their actions significantly influence your credit report indirectly. For more information on charge-off accounts, see this helpful resource: Charge-off information.

How TrueAccord Impacts Your Credit Score

TrueAccord acts as an intermediary between you and your original creditor. They manage communication and potentially negotiate settlements. Crucially, the original creditor remains responsible for reporting your payment activity to the credit bureaus. Therefore, missed payments while TrueAccord manages your debt will be reported, negatively impacting your credit score.

This means that regardless of whether you're directly communicating with your creditor or TrueAccord, missed payments will be reflected on your credit report. TrueAccord's role is primarily administrative; the credit reporting responsibility remains with the original lender.

The Good and the Not-So-Good About Working with TrueAccord

While the potential for negative credit impact exists, TrueAccord does offer some advantages:

Pros:

- Improved Communication: Many users find TrueAccord's communication methods (email, text, phone) more efficient than traditional collection agencies.

- Debt Settlement Potential: TrueAccord may negotiate settlements with creditors, potentially reducing the total amount owed. This can improve overall financial health, even though it still affects your credit.

- Enhanced Customer Service (Sometimes): Some individuals report more responsive and helpful customer service compared to traditional agencies, yet this is not a universal experience.

Cons:

- Inaccurate Information: Cases of TrueAccord conveying inaccurate information to creditors resulting in unfair negative credit impacts have been reported.

- Lack of Direct Credit Control: You cannot directly influence TrueAccord's reporting to credit bureaus; it's dependent on the original creditor's actions.

- Persistent Negative Credit Mark: Even successful settlements with TrueAccord typically leave a negative mark on your credit report for several years.

Protecting Yourself When Dealing with TrueAccord

Navigating debt collection can be stressful. These steps can help mitigate potential issues:

- Understand Your Rights: Familiarize yourself with the Fair Debt Collection Practices Act (FDCPA) (a U.S. law protecting consumers from abusive debt collection practices).

- Verify the Debt: Always confirm the legitimacy of any debt TrueAccord presents. Dispute inaccuracies promptly.

- Maintain Detailed Records: Keep comprehensive records of all interactions with TrueAccord, including dates, times, and content. This is critical for resolving disputes.

- Negotiate Strategically: If negotiating a settlement, aim for a "pay for delete" agreement—where the negative mark is removed after payment. However, this is not always guaranteed.

How to Mitigate Identity Theft Risks with Fintech Debt Collection Services

Fintech debt solutions present both convenience and increased identity theft risks. Protecting yourself requires a proactive approach:

- Strong Passwords and Authentication: Employ strong, unique passwords for all accounts and enable multi-factor authentication (MFA) whenever possible.

- Regular Credit Monitoring: Closely monitor your credit reports for unauthorized activity using services provided by credit bureaus.

- Scrutinize Collection Practices: Research and verify the legitimacy of any debt collection service before using it.

- Secure Communication: Beware of unsolicited contacts claiming to be from debt collectors. Only share sensitive information through secure channels you've initiated.

- Report Suspicious Activity: Immediately report suspected identity theft to the Federal Trade Commission (FTC) and the fintech company involved.

The Bottom Line on TrueAccord and Your Credit

TrueAccord streamlines debt management, but its impact on your credit hinges on your original creditor's reporting. While TrueAccord simplifies communication, it doesn't erase the consequences of past-due payments. Protecting your credit requires understanding your rights, maintaining thorough records, and engaging in strategic negotiations. Stay informed about evolving debt collection practices and their impact on credit scores.

Key Takeaways:

- TrueAccord doesn't directly report to credit bureaus, but missed payments reported by the original creditor negatively impact your credit score.

- While offering potential conveniences, TrueAccord also carries risks like inaccurate information and persistent negative credit marks.

- Proactive steps, including understanding the FDCPA and maintaining detailed records, are crucial for protecting your credit and financial well-being.